Right now, DIY tax platforms are designed for individuals with simple returns, and they don’t necessarily compete with CPA firms. However, their proactive communications throughout tax season are quite elegant and worth a closer look.

Leveraging their technology, these platforms communicate with customers and potential customers prior to tax season, during the tax preparation process and after. Since there is no personal relationship with a CPA, they enhance the client experience with regular, strategic email check-ins and feedback requests.

You may be very proactive throughout the year with your clients in an advisory capacity. When deadlines push and laws change rapidly, though, your firm could leverage marketing technology to stay in touch and productive.

Corporate clients are still run by individuals who are busy and don’t have time to check on the status of tax filings and payments or audits. Even so, they want to know that their CPA is on the job despite regulatory delays or deadline extensions. Take a cue from DIY tax services in these three ways to enhance your clients’ experience. They are simple and will be appreciated.

Hack #1 – Reminders to Connect

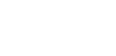

Once people have an account with a DIY service, the platform begins a series of emails with friendly reminders to get in touch. It’s their version of a tax planner, but they send it more than once to remind busy customers to get started.

Whether you are communicating with CFOs, administrators or owners, a series of pre-planning or reminder emails strengthens the client experience because it does not require the client to search through paperwork OR emails to find your firm’s instructions or request. When that reminder email shows up, your clients will appreciate the simplicity of following through.

These emails can be personalized and scheduled through your integrated CRM and marketing tools. In this DIY tax platform example, the email is reminding the client of a scheduled appointment. Busy people appreciate reminders.

Hack #2 – Automated Updates

With unprecedented tax changes over the past few years, CPAs have experienced an endless tax season. So have your clients.

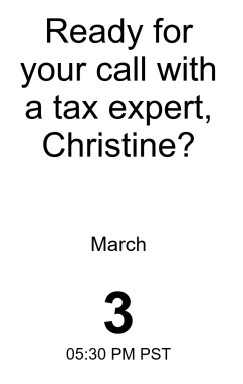

Amidst these changing tax laws, regulations and filing deadlines, the DIY platforms do a smart thing. They send regular updates to let customers know about the status of their returns.

In your automated email updates, you can give a status update, but also proactively let the client know what it means and what’s next for them.

These updates calm client concerns or frustrations. You will potentially avoid multiple calls or emails from clients, which disrupts your team’s productivity. Use your technology to set up these emails in advance. They can be as simple as:

“Good news! Your tax preparation is underway. I will let you know when I have more details on your filing date. Thank you for choosing us.”

OR

“Thanks for your patience. We are waiting on information from the IRS regarding some aspects of your return, and we will update you on filing status by March 17…”

[maxbutton id=”77″ url=”https://ingenuitymarketing.com/fostering-brand-loyalty/” text=”READ: Keys to Fostering Brand Loyalty for Your Firm ” ]

Hack #3 – Measure Client Satisfaction

DIY tax platforms always offer a survey or ask customers to review their service to help them improve it. The surveys are less than three minutes, but they target certain aspects of the tax filing process. They help the company identify service, technology or outcomes that people highly value or highly dislike.

Through your CPA firm marketing, you can offer a series of multiple choice and open-ended questions in a short survey following your key tax or audit engagements. They can be automated like the DIY tax platforms to feed your firm information about the client experience.

Surveys should be analyzed for action steps that support future communications. They can also help you identify new services to offer.

Using these three client experience hacks from DIY tax platforms can optimize the great advisory relationships you have built with loyal clients. They will also help new clients feel like they made the right choice with your firm. If you need assistance with client experience communications or setting up your automated digital marketing surveys, contact us at Ingenuity.